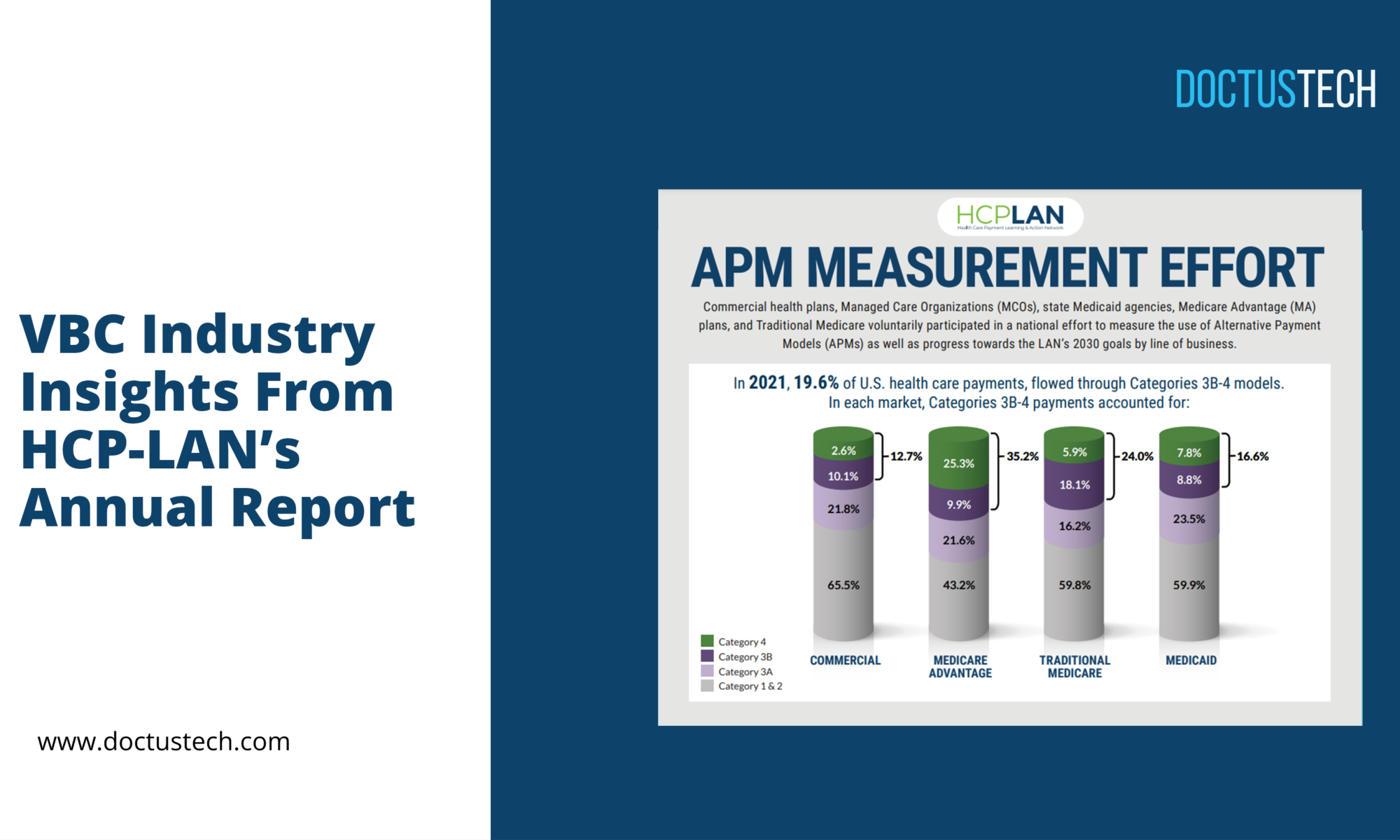

Values-based healthcare reimbursement has been adopted more quickly in some healthcare sectors than in others.

According to the LAN’s latest APM Measurement report, 40.9% of US healthcare payments—representing over 238 million Americans and more than 80% of the covered population—were generated through value-based reimbursement programs last year. Population-based payments and downside risk agreements were included in these programs, in addition to upside risk agreements.

In addition, almost one fifth (19.8%) of all healthcare payments made last year were in some way tied to value or quality of care while still being based in fee-for-service. The remaining 39.3% of payments were strictly fee-for-service.

Despite the fact that the healthcare industry has adopted value-based reimbursement, adoption is often glacially slow. But values-based reimbursement has been adopted quicker in some segments of the healthcare system.

Where progress is occurring.

According to the APM Measurement report, Medicare and Medicare Advantage are leading the charge in value-based reimbursement – no surprise there.

Just 15.0% of traditional Medicare payments and 38.0% of Medicare Advantage payments were fee-for-service in 2020, down from 2019 data showing 14.1% of traditional Medicare payments and 46.0% of Medicare Advantage payments being fee-for-service.

In both programs, the proportion of value-based reimbursement in two-sided risk alternative payment models continue to increase year over year. In traditional Medicare, 24.2% of payments were part of some two-sided risk model, compared to 20.2% in 2019. In Medicare Advantage, the percentage of payments in two-sided risk models increased from 28.6% in 2019 to 29.3% in 2020.

Insight: Medicare Full Risk grew by 20% between 2019 and 2020.

Medicare Advantage Full Risk grew only 3% in the same period.

Despite fee-for-service payments making up 59.0% of Medicaid payments in 2019, value-based reimbursement adoption increased from 10.6% to 14.5% in 2020.

Insight: Value-Based Reimbursement adoption grew 36% 2019-2020

According to the report, private payers covered 62% of the lives represented in the LAN’s data, but only 10.8% of payments made in 2020 were from two-sided risk models, while over half (51.5%) were from fee-for-service.

In addition, a higher proportion of payments to providers from private payers (11.1%) in 2019 was tied to two-sided risk models. Furthermore, 53.5% of payments were fee-for-service, as shown in the report.

How to accelerate value-based payment and risk

Industry experts at the 2021 LAN Summit concur that a lag in value-based reimbursement adoption is shown by the results of the 2020 APM Measurement report. However, there is speculation that risk-based models will be adopted more rapidly over the next few years.

According to the report, 87% of respondents believe that alternative payment model activity will increase; none of them believe it will decrease. In addition, the majority agreed that adoption would lead to higher quality, more accessible care, as well as improved care coordination.

Despite the payors’ perspectives, provider willingness to take financial liability, their capability to implement models, and their interest and willingness are still the greatest barriers to value-based payment adoption.

An “exponential” increase in the level of cooperation between payers and providers has occurred, and more providers are bringing to us the idea of entering into risk arrangements, Shrank said. Because of the outbreak, he thinks more people will be open to working in risk arrangements.

However, payers still must offer the right incentives to incentivize providers to participate in value-based reimbursement and eventual downside risk.

Keeping the momentum going with value-based reimbursement and risk adoption in healthcare requires leadership, buy-in, and aligned incentives.

https://hcp-lan.org/apm-measurement-effort/2022-apm/